| Coverage | Sum assured (baht) | ||||||

|---|---|---|---|---|---|---|---|

| Plan 1 | Plan 2 | Plan 3 | Plan 4 | Plan 5 | Plan 6 | Plan 7 | |

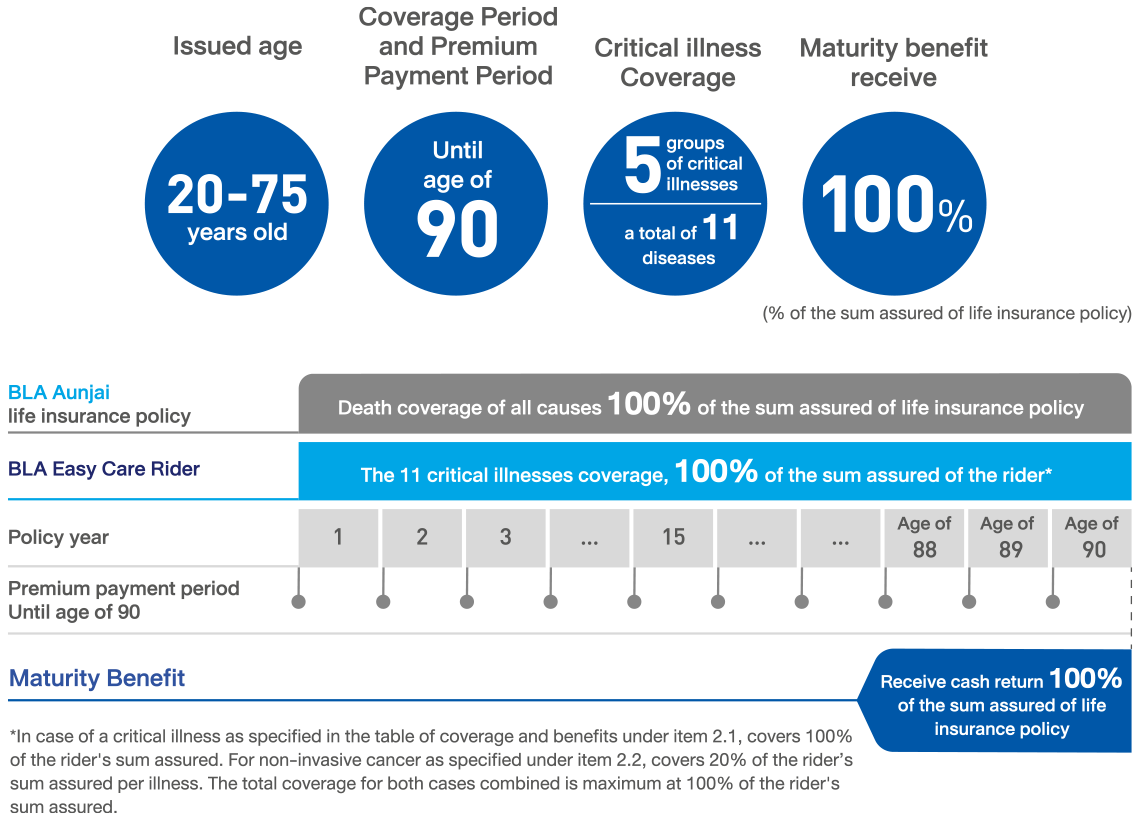

| BLA Aunjai life insurance policy | 50,000 | 50,000 | 50,000 | 50,000 | 50,000 | 50,000 | 50,000 |

| BLA Easy Care Rider | 100,000 | 200,000 | 300,000 | 400,000 | 500,000 | 750,000 | 1,000,000 |

| Coverage | Benefits |

|---|---|

| 1. BLA Aunjai life insurance policy | |

| 1.1 In the event of death | 100% of the sum assured |

| 1.2 In the event of living until the age of 90 | 100% of the sum assured |

| 2. BLA Easy Care Rider* | |

| 2.1 Coverage in case of critical illnesses as follows: | |

|

100%** of the sum assured |

| 2.2 Coverage of non-invasive cancer per time ("Total coverage" up to 100% of the sum assured) |

20% of the sum assured |

* The critical illness coverage benefit payment of BLA Easy Care rider has 90-day waiting period, starting from the policy's effective date. The company will pay benefit if the insured is diagnosed and/or confirmed by a doctor as having a critical illness with one of the 11 serious diseases covered.

** Critical illness coverage as defined in item 2.1 will be deducted by non-invasive cancer benefit amount according to item 2.2 (if any). The maximum coverage for both cases combined is 100% of the rider's sum assured.

The rider will automatically terminate once the company has paid the full amount.