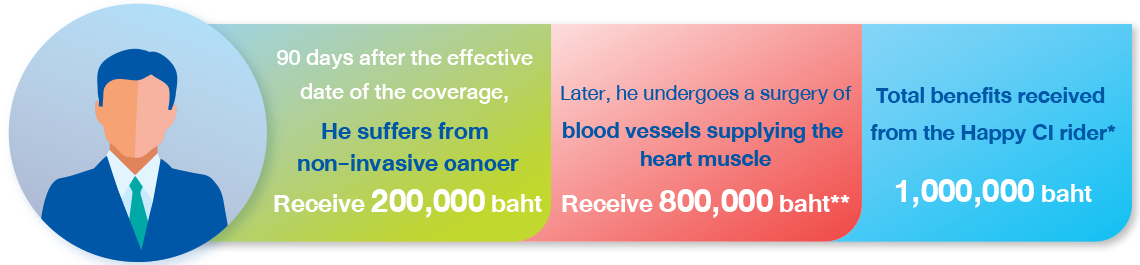

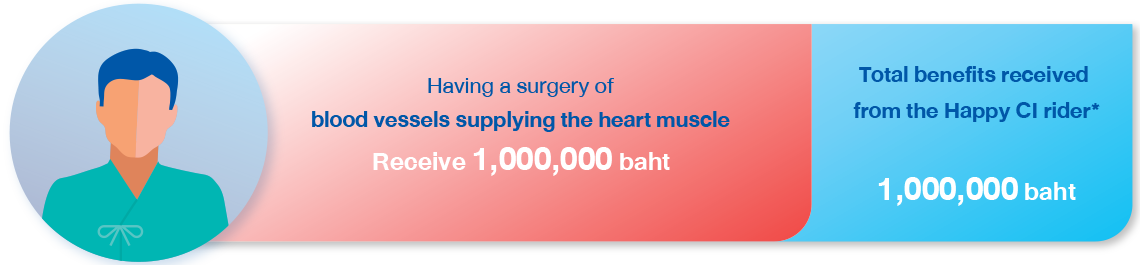

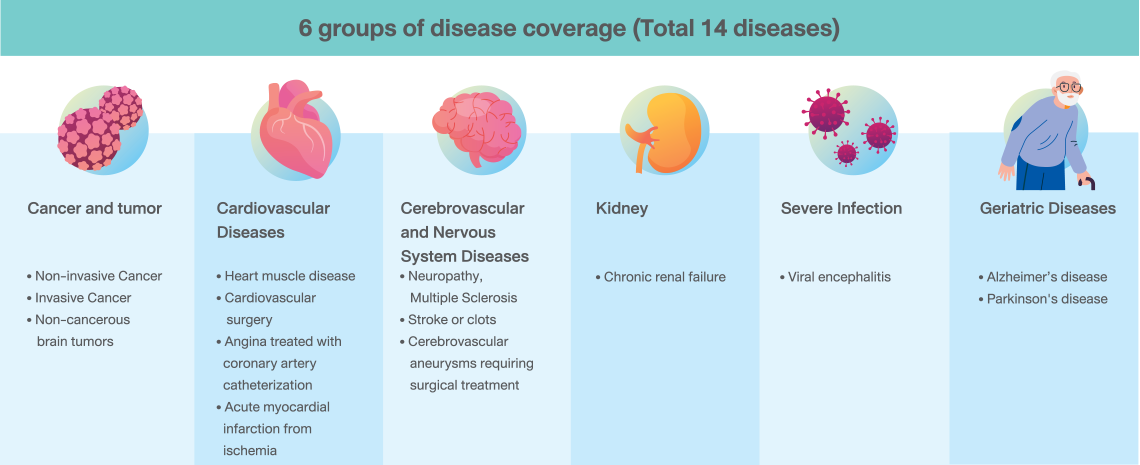

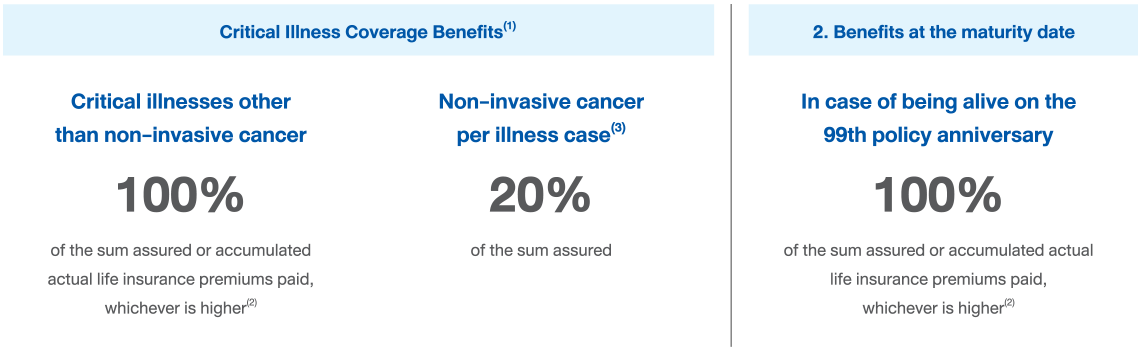

(1) Waiting Period of Happy CI rider is 90 days from the rider’s effective date. The company will pay the benefit if the insured is diagnosed and/or confirmed by a doctor while the insured is alive as having one of the 14 covered critical illnesses. The total critical illness benefit must not exceed 100% of the sum assured or the accumulated premiums paid for the rider, whichever is higher. In case that the total benefit paid is equal to the sum assured or the accumulated premiums paid for the rider, whichever is higher, the rider will be automatically terminated. Moreover, if the insured dies during the benefit payment process for benefit item 1.1 and/or 1.2, the company will pay the benefit to the beneficiary.

(2) Deducted by the critical illness benefits paid by the company (if any)

(3) Each newly diagnosed non-invasive cancer must not be related to, or a consequence of, non-invasive cancer for which the company has already paid the benefit. The remaining critical illness benefit will be reduced by the total benefit paid for non-invasive cancers.