- Value Health Kids Premier Rider: Issued age from 1 month – 10 years old

- The coverage period and the premium payment period for this plan are both 1 year. Additional coverage period can be purchased for the same duration as long as your life insurance product attached to your Value Health Kids Premier plan remains active, or until you reach the age of 99.

- Choose your own premium payment mode: annually, semi-annually, quarterly, or monthly (according to the main insurance contract)

- The health examination is in accordance with the company’s underwriting criteria

- OPD Sabai Jai endorsement cannot be purchased to attached to Value Health Kids Premier Rider

Health insurance that confidently cares for your little one with more comprehensive coverages, including both in-patient and out-patient medical expenses benefit, to ensure your child will be taken the best medical treatment when they are sick.

Room & Board and food up to 5,000 baht per day(1)

400,000 baht per once confinement(2)

within 24 hours of each accident

Feel at ease, even if you don't need to be hospitalized

a without deductible plan when the insured attained the age of 11(3)

(1) Room Benefit for Value Health Kids Premier Rider Plan 5000

(2) When combined benefits under Group 2 and Subgroup 4.1 - 4.4 must not exceed 400,000 baht for Value Health Kids Premier Rider Plan 5000

(3) From the policy anniversary year in which the insured attained the age of 11, the coverage plan will be automatically converted to a without deductible plan, according to the terms and conditions specified in the policy

Unit: Baht

| Benefits | Plan 3000 | Plan 4000 | Plan 5000 | |

|---|---|---|---|---|

| 1. In-patient benefits | ||||

| Group 1 | Hospital daily room & board, food, and hospital services charges (in-patient) per confinement, not exceeding 125 days | 3,000 per day | 4,000 per day | 5,000 per day |

| In the event of ICU, such benefit will be paid for hospital daily room & board, food, and hospital service charges (in-patient), will be twice paid for a maximum of 15 days, total benefit under group 1 must not exceed 125 days. | ||||

| Group 2 | Medical service for diagnosis or treatment, blood service and blood component, nurse service, medicine, parenteral nutrition, and medical supply per confinement | When combining the benefits of Group 2, must not exceed 30,000 | When combining the benefits of Group 2 and Subgroup 4.1 - 4.4, must not exceed 200,000 | When combining the benefits of Group 2 and Subgroup 4.1 - 4.4, must not exceed 400,000 |

| Subgroup 2.1 | Medical service fees for diagnosis | 30,000 | As charged | As charged |

| Subgroup 2.2 | Medical service fees for treatment, blood services and blood component, and nursing service | |||

| Subgroup 2.3 | Medicine, intravenous nutrition and medical supplies | |||

| Subgroup 2.4 | Expenses for Home medication and medical supplies (Medical Supply 1) per confinement, not exceeding 7 days | 1,000 | 1,000 | 1,000 |

| Group 3 | Medical professional service of examination physician per confinement, not exceeding 125 days | 800 per day | 1,000 per day | 1,200 per day |

| Group 4 | Medical expense for operation (surgery) and procedures per confinement | When combining the benefits of Subgroup 4.1 - 4.4, must not exceed 100,000 | When combining the benefits of Subgroup 4.1 - 4.4 and Group 2, must not exceed 200,000 | When combining the benefits of Subgroup 4.1 - 4.4 and Group 2, must not exceed 400,000 |

| Subgroup 4.1 | Operating or medical procedure room | 100,000 | As charged | As charged |

| Subgroup 4.2 | Medicine, intravenous nutrition, medical supplies and surgical devices | |||

| Subgroup 4.3 | Fees for medical professional services of surgery & procedure physician (and assistant) (Doctor Fee), according to the doctor fee guideline | |||

| Subgroup 4.4 | Fees for medical professional service of anesthetist (Doctor Fee), according to the doctor fee guideline | |||

| Subgroup 4.5 | Medical expenses for organ transplantation are covered as charged (Limited 1 time per lifetime for this rider) | 200,000 | 200,000 | 400,000 |

| Group 5 | Major Surgery as an out-patient (Day Surgery) | As charged (considered as an in-patient benefit) | ||

| 2. Out-patient benefits | ||||

| Group 6 | Medical service for a directly related diagnosis pre- and post-hospitalization or continuous and directly related out-patient medical expense after in-patient hospitalization per confinement | 3,500 | 5,000 | 5,000 |

| Subgroup 6.1 | Medical service for a directly related diagnosis occuring within 30 days pre- and post-hospitalization | |||

| Subgroup 6.2 | Out-patient medical expense after in-patient hospitalization per time for continuous treatment within 30 days after discharge, not exceeding 2 times (excluding fee for medical service for diagnosis) | |||

| Group 7 | Out-patient medical expense for injury within 24 hours of each accident | 6,000 | 8,000 | 8,000 |

| Group 8 | Post-hospitalization rehabilitation per confinement | Not covered | ||

| Group 9 | Medical services fees for chronic kidney failure treatment by-hemodialysis per policy year | 35,000 | 50,000 | 50,000 |

| Group 10 | Medical service for tumor or cancer treatment - radiotherapy, interventional radiology, nuclear medicine therapy per policy year | |||

| Group 11 | Medical services fees for cancer treatment by chemotherapy including targeted therapy per policy year | |||

| Group 12 | Emergency ambulance fee per time | 3,000 | 4,000 | 5,000 |

| Group 13 | Medical expense on minor surgery per time | 9,000 | 10,000 | 10,000 |

| Deductible per confinement (for benefits and coverage Group 1-5) (Effective until before the policy anniversary on which the insured attained the age of 11 years old) |

10,000 | 10,000 | 10,000 | |

| Additional Benefits | ||||

| Out-patient medical expenses benefits per time (Maximum 1 time per day and up to 30 days per policy year) | 2,000 | 2,000 | 2,000 | |

| Maximum benefit per policy year | None | |||

| Example Standard annual premium for male and female aged 3 years old | 43,855 | 58,698 | 67,698 | |

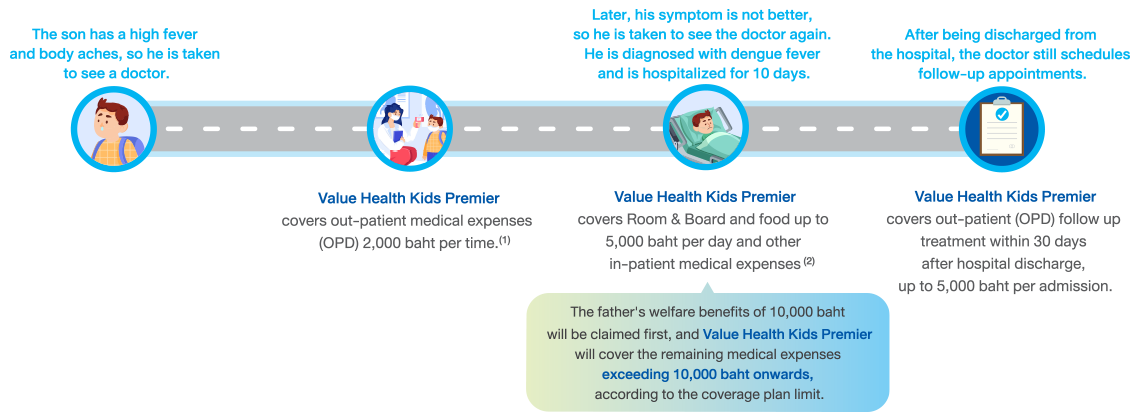

Example : A father has a medical expense for employee’s welfare from his company that covers his family. However, since the benefit he receives may not be sufficient, he purchases Value Health Kids Premier Rider Plan 5000 with a deductible of 10,000 baht per confinement for his 3-year-old son. The annual premium is 67,698 baht to cover more medical expenses and prevent unexpected high medical costs.

In the case that the son is sick and hospitalized before the policy anniversary when he attained the age of 11 years old

(1) Out-patient medical expenses benefit 2,000 baht per time (Maximum 1 time per day and 30 days per policy year)

(2) The maximum benefit is as stated in the Benefits and Coverage Table for each coverage category of Value Health Kids Premier Rider Plan 5000

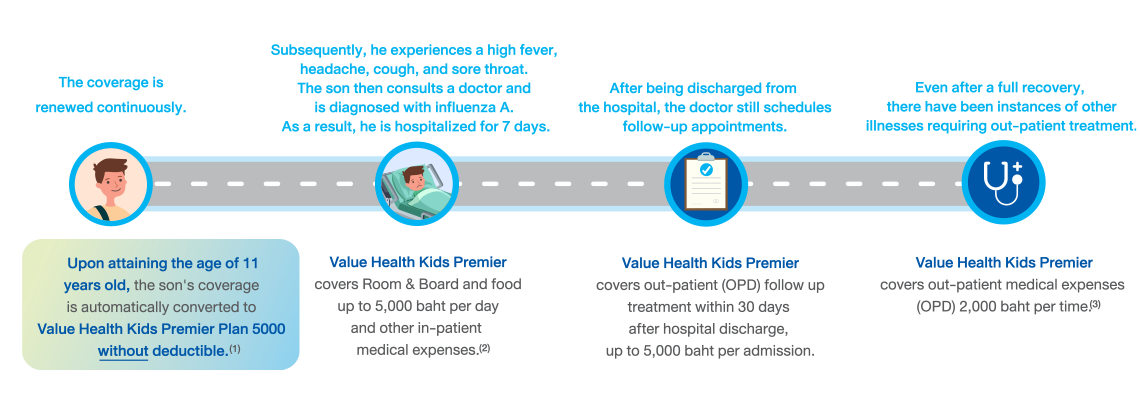

From the 11th policy anniversary onwards, the son's coverage will automatically be converted to Value Health Kids Premier Plan 5000 without deductible(1)

In the case that the son is sick and hospitalized from the policy anniversary when he attained the age of 11 years old onwards

(1) From the policy anniversary year in which the insured attained the age of 11, the coverage plan will be automatically converted to a without deductible plan, according to the terms and conditions specified in the policy

(2) The maximum benefit is as stated in the Benefits and Coverage Table for each coverage category of Value Health Kids Premier Rider Plan 5000

(3) Out-patient medical expenses benefit 2,000 baht per time (Maximum 1 time per day and 30 days per policy year)

Value Health Kids Premier Rider

Pre-existing medical conditions before the effective date: The company will not pay benefits under this rider for any chronic disease, injury or illness (including complications) which has not been fully cured prior to the first effective date of this rider except;

- The insured has disclosed the pre-existing conditions to the company and the company has agreed to accept the risk without the coverage exclusions; or

- Chronic disease, injury or illness (including complications) is asymptomatic, has not been treated or diagnosed by a doctor, or has not been seen or consulted by a doctor within 5 years prior to the first effective date of the rider and during 3 years from the date this rider becomes effective for the first time.

Waiting Period: The company will not pay the following cases for;

- Any illnesses occurring within 30 days from the effective date of this rider or the date on which the company approves the additional benefits of this rider, whichever date is later or

- Any of the following illnesses occurring within 120 days from the effective date of this rider or the date on which the company approves the additional benefits of this rider, whichever date is later such as

| Tumor, cysts, or any type of cancer | Hemorrhoids | All types of hernia | Pterygium or cataract |

| Tonsillectomy or adenoidectomy | All types of stones | Varicose veins in the legs | Endometriosis |

- Tumor, cysts, or any type of cancer

- Hemorrhoids

- All types of hernia

- Pterygium or cataract

- Tonsillectomy or adenoidectomy

- All types of stones

- Varicose veins in the legs

- Endometriosis

Value Health Kids Premier Rider

This rider does not cover any expenses incurred from hospital treatment or any damages incurred from Injuries or Illnesses (including any complications), symptoms or abnormalities arising from:

- Conditions that are caused by congenital abnormalities, or congenital organ systems defects, or genetic disorders, or pervasive development disorders

- Cosmetic surgery or any other treatments for skin beauty purposes, pimple and blemish treatments, dandruff and hair fall treatments, or weight control, or elective surgeries

- Expenses incurred from the diagnosis and treatment that the Insured is acting as his/her own Physician, and also such expenses that the Insured's parent, spouse, or child is acting as the Physician

- Suicide, suicide attempt, or self-inflicted injuries

- Injuries arising while under the influence of alcohol or narcotic drugs or substance up to the state of insanity or psychiatric or psychological disturbance. “While under the influence of alcohol” means the blood test shows alcohol level from 150 milligram percent and over.

Note

- This advertising media is only a summary of preliminary benefits. Please read the details of the coverage conditions and exclusions before deciding to purchase any insurance products. The coverage conditions and complete exclusions can be inquired from your agents or from your life insurance policy details.

- Premium payments is the responsibility of the insured. Premium collection by life insurance agents and brokers is a service only

- A health declaration is one of the factors for underwriting or benefits payment consideration

- Insurance underwriting is in accordance with the company’s underwriting conditions

- Value Health Kids Premier Rider health insurance premiums may be adjusted based on several factors, including the individual’s age, occupation, the rising medical treatment costs, or the overall compensation payment experience of the portfolio of this additional rider.

- Value Health Kids Premier Rider health insurance premiums is eligible for tax deduction in accordance with the announcement from the Revenue Department

- The territory of according to the coverage benefits of the rider is Thailand only

- In the event that the insured has claim history in accordance with one of the copayment conditions in the renewal year, the copayment requirements will be added into the coverage agreement (for the new health standard policy which has an effective date starting from 20 March 2025 onwards)