- Issued age 11-80 years

- The coverage period and the premium payment period for this plan are both 1 year. Additional coverage period can be purchased for the same duration as long as your life insurance product attached to your Prestige Health Unlock plan remains active, or until you reach the age of 99

- Choose your own the premium payment mode: annually, 6-monthly, 3-monthly, or monthly (according to the main life insurance contract)

- One person can only have one active Prestige Health Unlock policy

- The health examination is in accordance with the company's underwriting criteria

Unlock more protection for more benefits

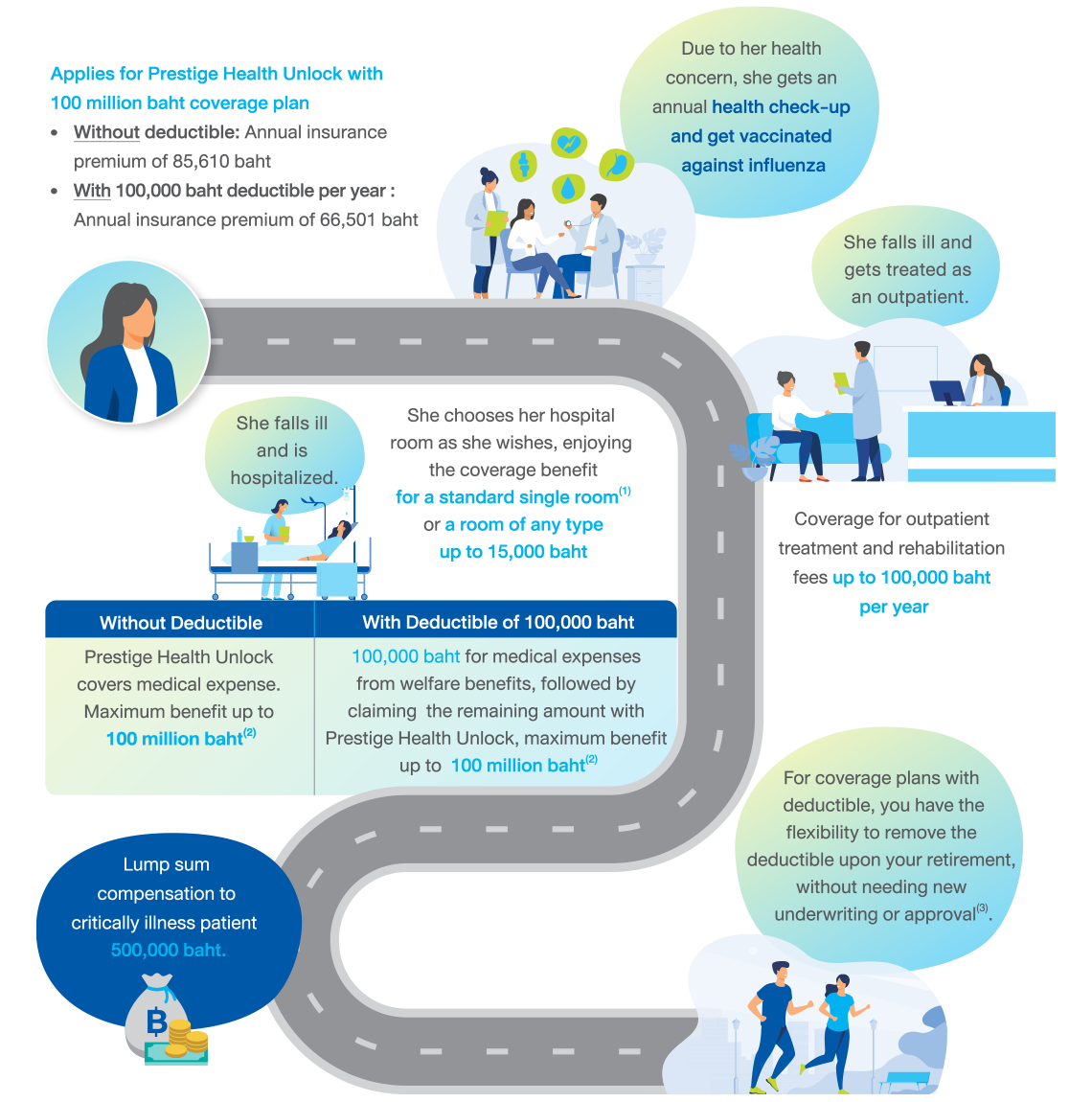

- Standard single room coverage(1) or a room of any type,

up to 8,000-25,000 baht per day, whichever is higher.

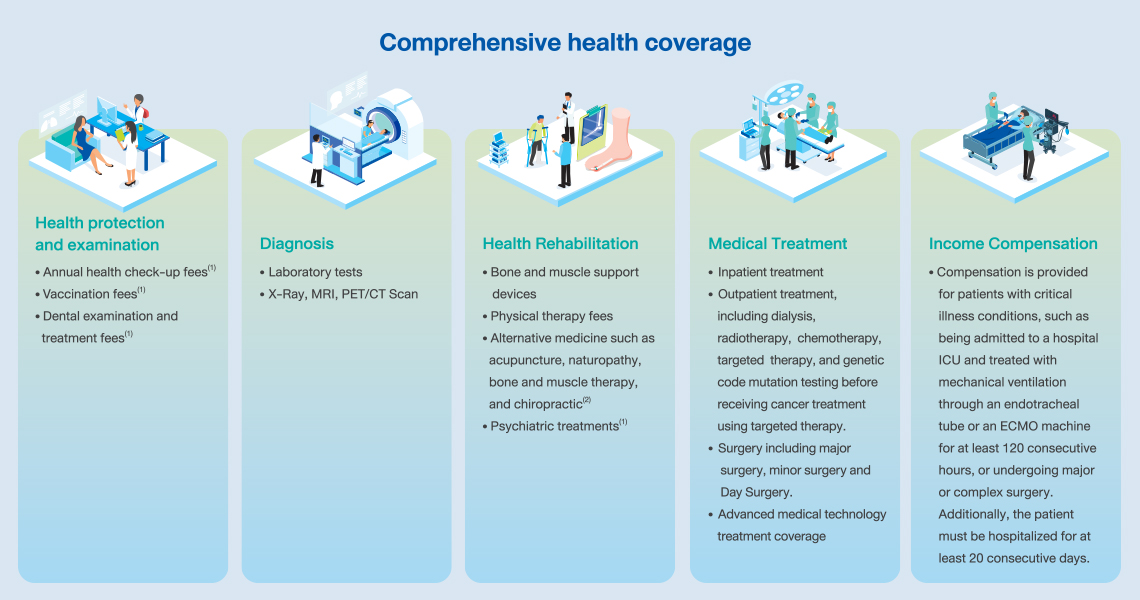

- Targeted Therapy for cancer coverage

- Advanced medical technology treatment coverage, such as cancer treatment by immunotherapy, Stem Cell Therapy, or other advanced treatment methods(2)

- Compensation for critically illness

- Benefits of alternative medicine such as acupuncture, naturopathy, bone and muscle therapy, chiropractic, and Chinese medicine.

- Annual health check-up fees, vaccination fees, psychiatric treatments

- Dental examination and treatment fees

- Choose your coverage plan: with / without deductible(3)

- Enjoy a freedom to flexibly adjust your deductible coverage plan to maximize your welfare benefits(4).

- Choose your own coverage area: Thailand/Asia/Worldwide, except USA and United States Minor Outlying Islands/Worldwide

The coverage terms and conditions are specified in the insurance policy issued to the policyholder. Coverage value must not exceed the benefits specified in the Table of Benefits for each coverage category of Prestige Health Unlock health insurance.

(1) “Standard single room" means the starting price for an inpatient private room at a hospital for inpatient confinement in Thailand only.

(2) Such advanced medical technologies must be certified by the Royal Academy of Thailand under the recognization of the Medical Council of Thailand which oversees the relevant medical fields.

(3) “Deductible” means to the first part of the damage that the insured must be responsible according to the terms of the insurance contract in the coverage area of Thailand only.

(4) Only policyholders between the ages of 55 and 65 with continuous 5-year coverage under their current deductible plan can upgrade to the no-deductible plan within their original coverage plan. However, the conditions are in accordance set by the company.

The coverage terms and conditions are specified in the insurance policy issued to the policyholder. Coverage value must not exceed the benefits specified in the Table of Benefits for each coverage category of Prestige Health Unlock health insurance.

(1) For the100 million baht coverage plan and above

(2) For the 50 million baht coverage plan and above