| Coverage | Benefits |

|---|---|

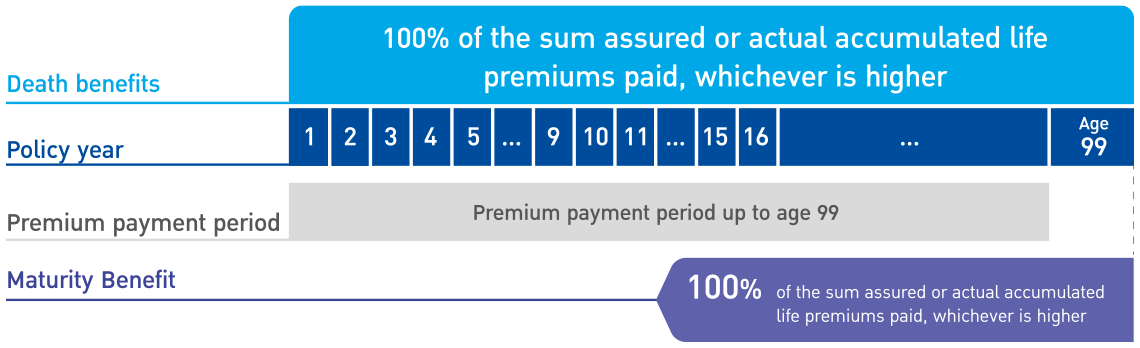

| Death benefit |

|

| Maturity benefit |

|

- Issued age: Newborn - 80 years

- Coverage period and premium payment period: up to age 99 years

- Minimum sum assured: 50,000 baht

- Premium payment mode: Annually, semi-annually, quarterly, and monthly

- BLA Whole Life 99/99 policyholders must first purchase either a health rider or a critical illness rider before they can buy additional riders

- Health check-ups are in accordance with the company's insurance underwriting criteria

Note: If the insured is a minor, a Payor Protect rider must also be purchased.

Click to view Benefits and Coverage

Click to View Coverage Exclusions

- In the event that the insured does not disclose the true statement or makes a false statement, the company will void the contract within two years from the effective date of the coverage under the insurance policy, or upon renewal, or upon reinstatement, or upon the date the company approves the increase of the sum insured only for the additional part. Unless the insured does not have a stake in the insured event, or the declaration of age is inaccurate that the actual age is outside the normal trade premium rate limit.

- In the event the insured commits suicide within one year from the effective date of the insurance policy, or upon renewal, or upon reinstatement, or upon the date the company approves the increase of the sum insured only for the additional part, or if murdered by the beneficiary.

Note

- Information on the website is only a summary of preliminary benefits. Please read the details of the coverage conditions and exclusions before deciding to purchase any insurance products. The coverage conditions and complete exclusions can be inquired from your agents or from your life insurance policy details.

- Premium payment is the responsibility of the insured. Premium collection by life insurance agents and brokers is a service only

- A health declaration is one of the factors for underwriting and benefits payment consideration

- For maximum benefits from the policy, the insured should pay premiums until the premium payment period completes and hold the policy until its maturity

- BLA Whole Life 99/99 premiums is eligible for tax deduction in accordance with the announcement from the Revenue Department

For more details, please contact our life insurance agents or financial advisors nationwide.