| Coverages | Benefits | ||

|---|---|---|---|

| Bangkok Smart Kids 15/9 |

Bangkok Smart Kids 18/12 |

Bangkok Smart Kids 21/15 |

|

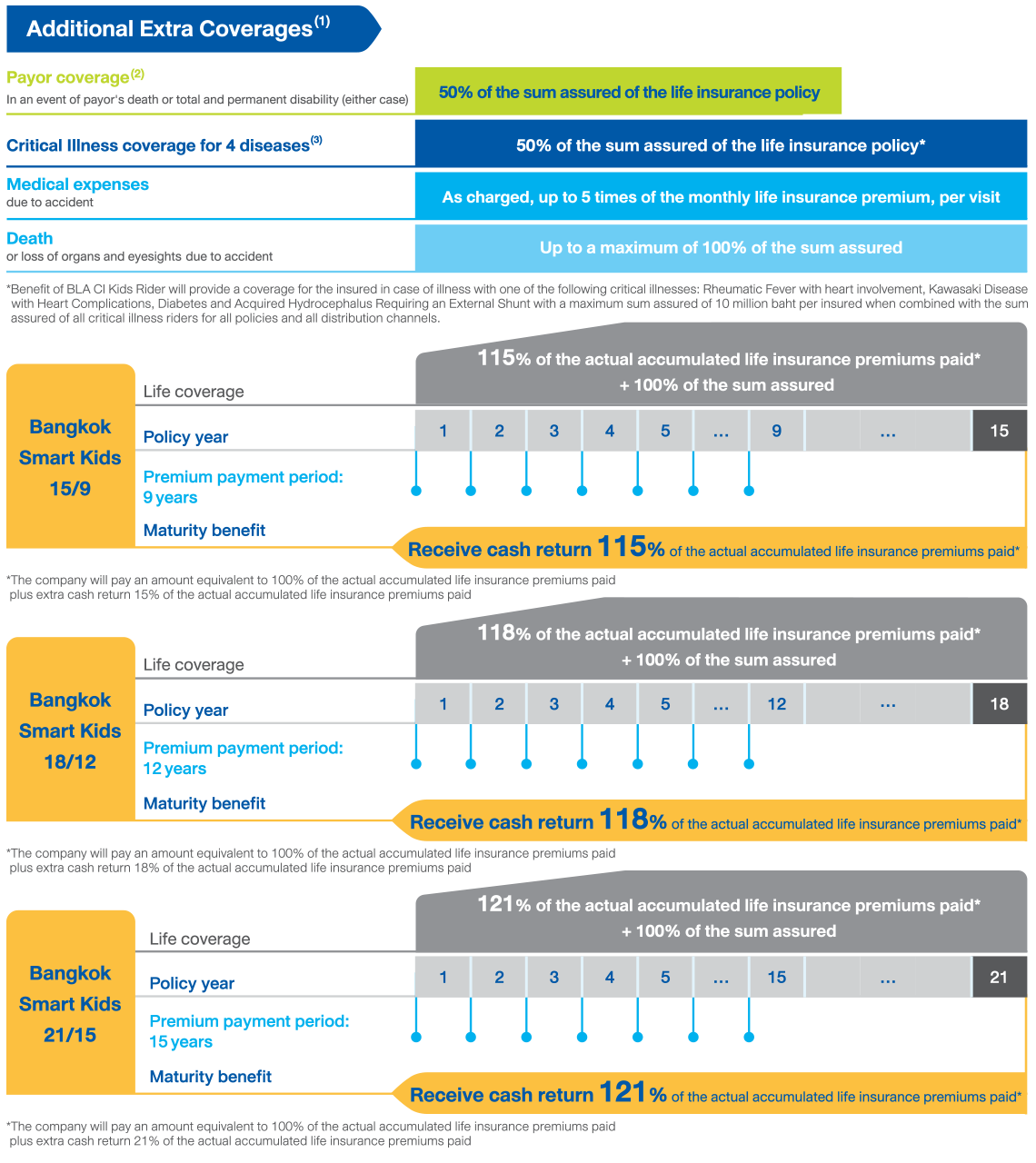

| 1. In the event of alive until the maturity | Receive 115% | Receive 118% | Receive 121% |

| (% of the actual accumulated life insurance premiums paid) | |||

| 2. In the event of death | Receive 115% | Receive 118% | Receive 121% |

| (% of the actual accumulated life insurance premiums paid) | |||

| Plus 100% of the sum assured | |||

| Receive additional extra coverage | |||

| 3. In the event of death or loss of organs and eyesight due to accident | |||

| 3.1 In the event of accidental death | Receive additional 100% of the sum assured | ||

| 3.2 In the event of loss of organs and eyesight | |||

| 3.2.1 Loss of 2 hands or 2 feet, or 2 eyes | Receive additional 100% of the sum assured | ||

| 3.2.2 Loss of 1 hand and 1 foot, or 1 hand and 1 eye, or 1 foot and 1 eye | Receive additional 100% of the sum assured | ||

| 3.2.3 Loss of 1 hand, 1 foot, or 1 eye | Receive additional 60% of the sum assured | ||

| 3.2.4 Loss of the thumb and index finger of the same hand, severed at or above the base of the fingers | Receive additional 25% of the sum assured | ||

| 4. Medical expenses due to accident (within 52 weeks from the date of accident) |

As charged, up to a maximum of 5 times of monthly life insurance premiums (per visit) |

||

5. Coverage for 4 Critical illnesses for child :

|

Receive additional 50% of the sum assured | ||

| 6. In the event that the payor's death or diagnosis by a doctor as being total and permanent disability (either case) |

Additional receive 50% of the sum assured | ||

- The company will pay the benefits under Clause 3 if the injury results in death or loss of organs and eyesight within 180 days from the date of accident or the injured person requires continuous hospitalization as an in-patient and dies as a result of the injury.

- The benefits under Clause 3 will be reduced by the amount of benefits paid under Clauses 3.2.3 and/or 3.2.4 (if any). Once the company has paid 100% of the sum assured, the coverage under Clause 3 will terminate.

- Loss of a hand or foot means amputation from the wrist or ankle, including the complete and permanent loss of function of that organs as a result of an accident

- Loss of eyesight means total blindness with impossibility of recovery

Example of annual premium rates per sum assured 1,000 baht

Unit : baht

| Age(Years) | Bangkok Smart Kids 15/9 | |

|---|---|---|

| Female | Male | |

| Newborn | 73.13 | 74.29 |

| 5 | 72.54 | 75.97 |

| 10 | 73.51 | 81.70 |

| Bangkok Smart Kids 18/12 | |

|---|---|

| Female | Male |

| 45.19 | 46.44 |

| 44.97 | 47.96 |

| 45.57 | 51.27 |

| Bangkok Smart Kids 21/15 | |

|---|---|

| Female | Male |

| 31.71 | 33.07 |

| 31.59 | 34.17 |

| 32.02 | 36.35 |