- BLA Happy Health Premier Rider: Issued age from 11 - 80 years old

- Coverage period and premium payment period is one year. The coverage can be renewed for a period equivalent to the term of the life insurance contract that the BLA Happy Health Premier Rider attached to, or up to the age of 99 years old.

- Premium payment period: annually, semi-annually, quarterly, and monthly (according to the life insurance contract)

- Health check-ups are in accordance with the company's underwriting criteria

Be happier with enhanced coverage. Worry-free about medical expenses

Covers a standard single room in any hospitals(1),

or a maximum of 5,000 baht per day(2),

whichever is higher

Fees for medical professional services of surgery and procedures, and anesthetist, as charged

Dialysis, Cancer treatment (Targeted therapy),

chemotherapy, and radiotherapy,

as charged up to 5,000,000 baht(3)

In case of critical illness or injury, receive a lump sum of 300,000 baht(4)

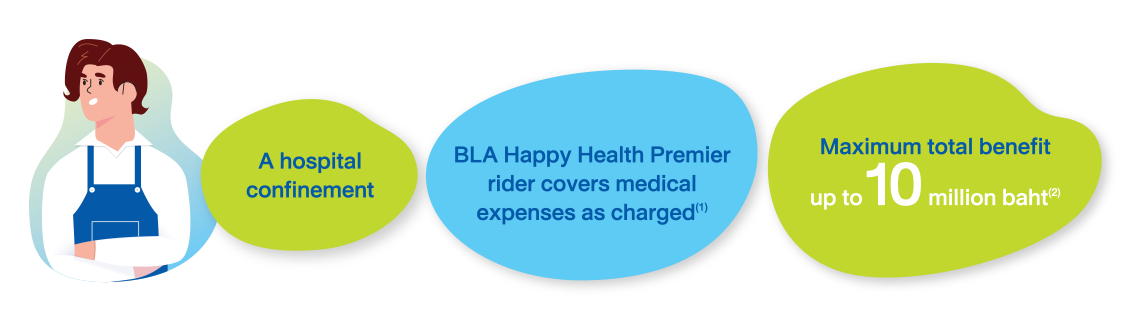

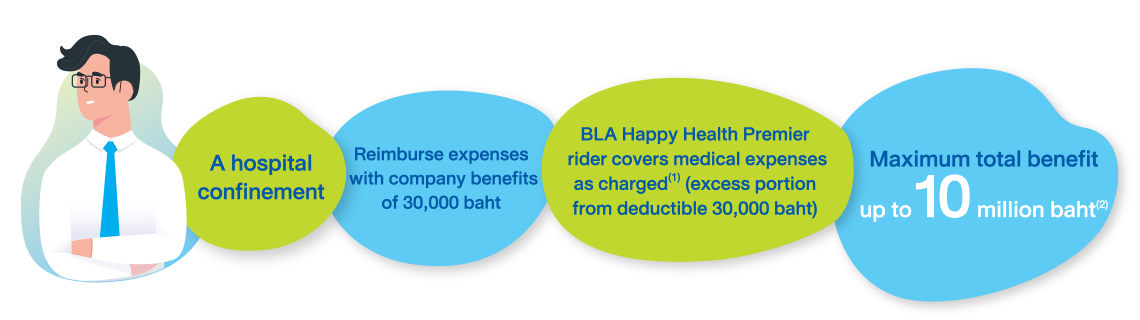

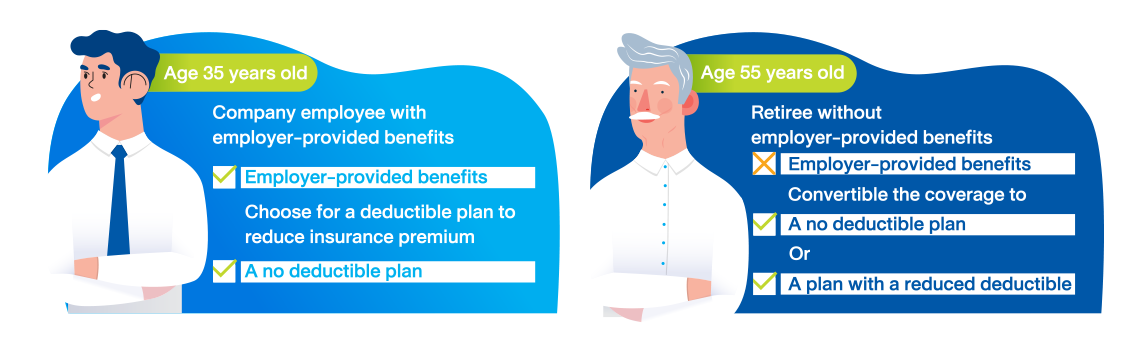

With or without deductible(5),

with a freedom to adjust your plan

to match your welfare

(1) Standard single room means the starting price for a single room at the hospital

(2) Room & board, food, and in-hospital services (in-patients) per confinement for the 10 million baht plan

(3) Medical expenses for the treatment of diseases in Groups 9, 10 and 11 (for outpatient), for the 10 million baht plan

(4) Critical illness coverage for the insured who suffers an injury or illness that necessitates medical treatment according to medical standards, as specified below:

(4.2) Transplantation, including heart, lung, liver, kidney, pancreas, intestine, and bone marrow transplants

(4.3) Physician-approved major organ surgeries for the treatment of a medical condition

(4.4) Intensive care unit (ICU) stay requiring mechanical ventilation or cardiopulmonary support for at least 120 consecutive hours per confinement

(4.5) In-patients stay for a continuous period of 20 days or more, including complicated surgery as specified during confinement.

However, there is a 90-day waiting period from the coverage’s effective date of the contract.

(5) Deductible means to the initial part of the loss that the insured must be responsible according to the terms of the insurance contract